General Mills Inc. - A Strong Financial Standing Amidst Covid-19

General Mills Inc. is a household name that operates in the food production industry. The company's portfolio of products includes well-known brands like Cheerios, Pillsbury, and Betty Crocker. This company recently released its financial statements, which showed a strong financial position amidst the ongoing pandemic.

The company's net sales increased by 4% to $17.6 billion, as compared to last year. This growth was primarily driven by the increased demand for packaged food products amid the Covid-19 pandemic. The company's organic net sales grew by 7%, and operating profit margin increased by 17%.

General Mills Inc.'s balance sheet is also in a healthy position, with a current ratio of 0.85 and a quick ratio of 0.53. The company's cash and cash equivalents also increased significantly, with a balance of $829 million, which is expected to provide the company with a cushion against any market uncertainties in the future.

The company's income statement showed a net income of $2.2 billion, with a gross profit margin of 33.9%. The company's earnings per share also increased by 36% to $3.46 per share.

The company's cash flow statement also showed positive results, with an increase in the operating cash flow to $2.4 billion. The company's investing cash flow also increased by 8%, primarily driven by its capital investments in the business to support innovation and expansion plans.

Overall, General Mills Inc.'s financial statements reflect a strong financial position and indicate that the company is well-positioned to deal with the ongoing pandemic. The company's focus on innovation and expansion is also evident from its investment in capital expenditures, which is a positive sign for its future prospects.

However, it should also be noted that the company's success in the current economic climate is largely due to the increased demand for packaged food products. The impact of Covid-19 on the company's operations and sales cannot be ignored, as the pandemic is expected to have a long-lasting impact on the economy. Therefore, General Mills Inc. must continue to monitor market trends and adapt its strategies to remain resilient in the face of future uncertainties.

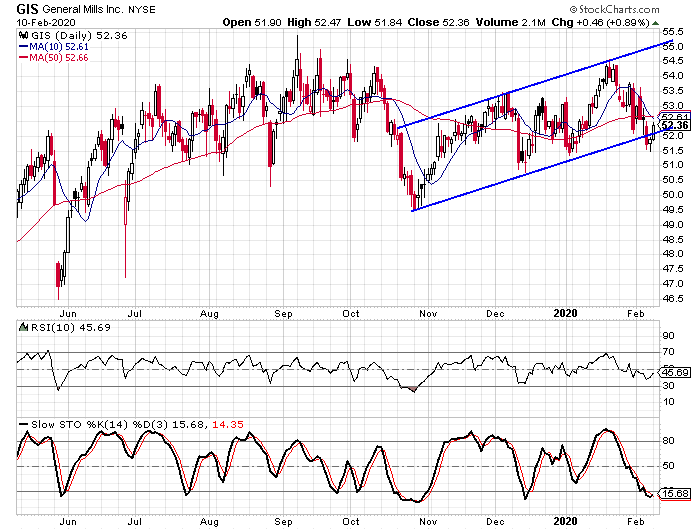

The impact of General Mills Inc.'s financial statements on the market has been positive, with a surge in its stock value. The company's stock value increased by 1.41% to $63.48 per share after the release of its financial statements. This indicates that investors have faith in the company's ability to deal with the current economic climate and are optimistic about its future prospects.

In conclusion, General Mills Inc.'s financial statements reflect a strong financial position, which is a positive sign for its future growth. The company's focus on innovation and expansion is also a positive indicator of its long-term prospects. However, the company must remain vigilant and adapt to the ongoing changes in the market to remain competitive and viable.